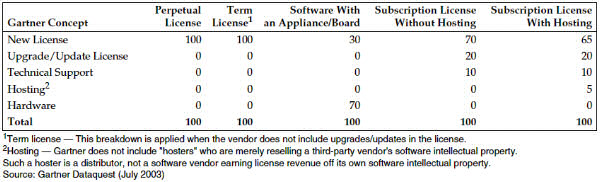

We can identify five revenue-generating components for software companies. These components have a deep impact on the business model and costs structure of this kind of companies:

- Product new license revenue: the initial fee, typically one-time charge, based on different factors: number of seats, of processors, of MIPS, of instances in memory, of granted simultaneous accesses, one-location license (eg: per data-center), company-license (eg: right-of-use within one holding, including all its subsidiaries), clustering-type, etc. The license-fee can be linked with the number of stages (integration, test, production). It works differently for the development frameworks, tools, utilities, etc. (number of developers, of simultaneous uses, etc.)

- Product update / upgrade license revenue: fee paid usually annually for having the right to install all software updates and updgrades. A percentage of the initial license fee (product update + technical support = about 15% of the initial fee). Differenciation between major and minor updates and upgrades

- Technical support revenue: usually an annual fee, also a percentage of the initial license fee. Included telephone support, access to a knowledge-base, web-based support, typically no on-site support.

- Services, training and consulting revenue: one-time charge, time & material (T&M;). Daily rates, with or without expenses and infrastructure.

- Hosting revenue (optional): for all-in-one solution where the software company proposes also the application hosting to its client (eg: salesforce.com, groove). The revenue model is typically linked with the actual usage of the application (number of business transactions) and volume discounts, which drives to a quite linear and well-known development of the costs.

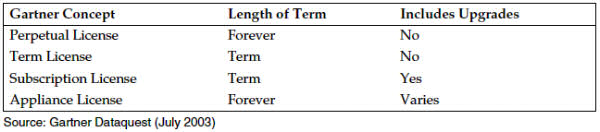

There are furthermore four software licensing models, which differ from each others because of the integration or not of technical support and update/upgrade and because of the length of time for the validity of the license:

- Perpetual license: about 90% of the licensing model worldwide, usually not included updates/upgrades and technical support or just for the first year.

- Term license: also called lease license or rental license.

- Subscription license: generally two types are possible: in-house installation or hosted application (eg: salesforce.com, groove)

- Appliance license: application sold with a specific hardware (eg: firewalls)

License type matrix

Typical software business models