[via whatsnextblog.com]

Technorati is about to be sold to a large search engine company. The deal should go down in about a week.

[via whatsnextblog.com]

Technorati is about to be sold to a large search engine company. The deal should go down in about a week.

[via Seth]

Again, a very good, solid and interesting development of the Long Tail concept from Chris Anderson. Have a look, this analysis represents a *huge* trend.

The rise of shorter, smaller content is actually a trend that’s affecting all media and entertainment, reflecting not just the taste of a quick-change generation but also an increasing variety and flexibility in the ways we can consume media. As we leave the era of one-size-fits-all distribution, we’ll increasingly see the end of one-size-fits-all content. Indeed there’s an increasing amount of evidence that this is already underway:

- Music: Consumers are moving from albums to singles.

- TV: Networks are looking for short video that works as well online as on broadcast.

- Movies: Online distribution is creating a big new audience for short films.

- Videogames: Between cellphone games, “casual” web games and downloadable content, smaller games are on the rise.

- Magazines: Reflecting the pace of a browse-and-skim culture, articles are getting shorter.

[via vowe]

I haven’t tested this, but it seems to be interesting. If you have a *dynamic* WinXP installation – i.e if you are instaling/uninstalling/testing a lot of softwares and tools, you surely have already re-installed your machine, because of the performance.

It seems that there is a way to avoid the re-activation process after your re-installation, by backup-ing a small file called WPA.DBL (in \windows\system32\) and by replacing this file after the re-install.

Have a look at the full article.

CDex is an old-fashioned tool (release 1.51 from September 2003!!) but surely still one of the best Audio CD Ripper. Completely free (Open Source), very powerful but quite easy to use, very stable. A must-have.

I ripped about almost all my CDs (> 900) with this tool.

CDex is a tool to do all sorts of things audio related. Mainly focused on ripping and converting, things like turning your home Compact Disc collection into an mp3 collection on your hard drive become extremely easy. With built in support for many encoders you wont find any shortage of options for your media files. Below is a more in-depth explination of CDex features.

CDex Feature List:

* Easy to use interface

* Media File Player

* Create PLS and M3U playlist files

* Advanced jitter correction

* Support for many file formats/audio encoders (WAV, MP3, OGG, VQF, APE, etc)

* Support for ID3 V1 and V2 tags

* Support for normalization of audio files

* Support for transcoding of compressed audio files

* Support for CDDB

* Support for recording from the analog input line

CDex is one of the most downloaded application (all-time) at sourceforge (more than 24 million downloads!).

[via Rodrigo]

[via Rodrigo]

If you have some interest in the Open Source field, worth a bookmark, to my mind ;-)

InfoWorld released a very extensive and *great* report about, I think, all the current Open Source projects for the following fields:

- A buyer’s guide to open source

Open source provides low-cost, community-supported alternatives to commercial enterprise apps- Open source business intelligence

Low-cost alternatives to costly reporting tools will arrive soon- Open source business process management

Orchestrating SOA is a heady task, but new projects are stepping up to the plate- Open source content management

The hardest part of choosing a CMS solution is narrowing down the choices- Open source CRM

Manage sales and customer relationships without spending a fortune on software- Open source ERP

The features of free ERP packages vary widely, but some gems can be found- Open source enterprise service bus

Middleware options proliferate, but jumping ship from commercial vendors may be premature- Open source identity

Free tools can give developers a head start on advanced security infrastructure- Open source directory

LDAP servers move closer to becoming commodity items- Open source portals

Competition in the open source Java portal space heats up- Open source point of sale

Free commerce terminals lend flexibility to businesses of all sizes- Open source RFID

Free tag and EPC data management software is in its infancy, but looks promising- Open source VoIP/Telephony

Options abound for PBX applications and interactive voice response- Open source licensing offers many choices

Before you use that code, make sure you understand its terms

InfoWorld also published a PDF report (free subscription required).

Synop, the company which was developping SauceReader, my RSS/Atom reader for quite a while now, has closed for business.

The SauceReader source code and product are for sale.

I will have to move to another reader, although this one was ok for my own usage :-( I am actually not really convinced that you have a big chance to *sell* a product of a company which is out. Strange process, to my mind.

I’ve missed this news from May ’05 but I haven’t read anything about this on-line. Standard&Poor;’s cut debt ratings for General Motors and Ford to “junk status” or “non-investment-grade” in May 5, 2005. In other words, G.M. and Ford are rated as junk bonds….

End of March 2005, G.M. had a consolidated debt of $292 billion and Ford a total debt of $161 billion!! That means, G.M. and Ford together have a cumulated debt of … $453 billion.

Just to give you a possible comparison: Spain, with 43 million inhabitants, had a public debt of $485 billion in 2004 (source: Wikipedia)…

Have a look at this NYTimes’ article (free registration required).

In explaining the downgrades, the agency used nearly identical language to describe a range of parallel concerns at each company, like falling sales of sport utility vehicles as gas prices have risen.

G.M.’s downgrade “reflects our conclusion that management’s strategies may be ineffective in addressing G.M.’s competitive disadvantages,” S.&P.; said in its report. For Ford, “the downgrade to non-investment grade reflects our skepticism about whether management’s strategies will be sufficient to counteract mounting competitive challenges,” S.&P.; wrote.

[S.&P.;] also blamed much of the companies’ problems on their huge financial commitments to its retirees, both in pensions and in medical benefits. Ford’s unfunded pension liability was $12.3 billion and its unfunded medical liability $32.4 billion at the start of the year, S.& P. said, while G.M.’s unfunded medical liability was $61 billion.

[via Joi]

Have a look at the official press release and at the Mozilla website.

On August 3rd, 2005, the Mozilla Foundation, a non-profit public benefit software development organization, launched a wholly owned subsidiary, the Mozilla Corporation. The Mozilla Corporation is a taxable subsidiary that serves the non-profit, public benefit goals of its parent, the Mozilla Foundation, and will be responsible for product development, marketing and distribution of Mozilla products.

The board of the Mozilla Foundation includes Mitch Kapor, Brian Behlendorf, Mitchell Baker, Brendan Eich, and Joichi Ito.

The board of directors of the Mozilla Corporation includes Mitchell Baker, Christopher Blizzard, and Reid Hoffman, CEO of LinkedIn. Mitchell Baker is president of the Mozilla Corporation.

[via CICLOPS]

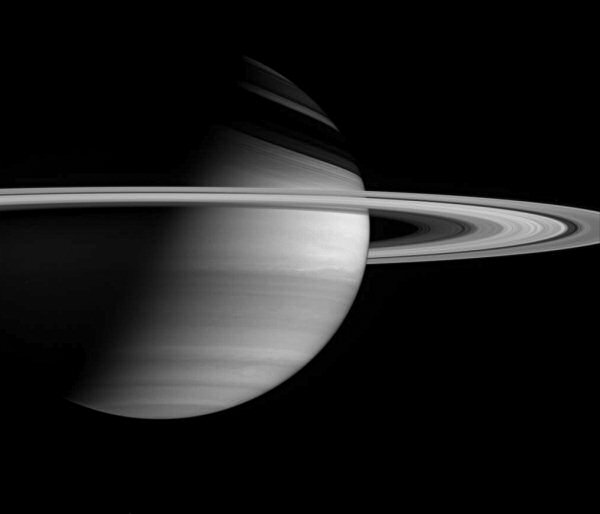

Cassini offers this lovely, crisp view of Saturn, which shows detail in the planet’s banded atmosphere, as well as the delicate ring system.

The image has been rotated so that north on Saturn is up; the Sun illuminates Saturn from below. Saturn’s tilt throws ghostly shadows of the rings onto the northern hemisphere during the current season.

The image was taken with the wide angle camera on January 23, 2005, from a distance of approximately 2.8 million kilometers (1.7 million miles) from Saturn through a filter sensitive to wavelengths of infrared light centered at 728 nanometers. The image scale is 166 kilometers (103 miles) per pixel.