Interbrand published its yearly global brands ranking by value for 2005. As usual, the results are quite interesting, have a look also at this BusinessWeek article.

Interbrand published its yearly global brands ranking by value for 2005. As usual, the results are quite interesting, have a look also at this BusinessWeek article.

Definition of the Brand Value

Brand Value is the dollar value of a brand calculated as net present value (NPD) or today’s value of the earnings the brand is expected to generate in the future.

Goal of this valuation

The purpose of these valuations is to demonstrate to the business community that brands are very important business assets and in many cases the single most valuable company asset. We also aim to make branding and marketing a key business issues that have direct shareholder value impact. Through 7 years of publishing BGB we have created the world’s most significant and influential brand and marketing survey.

Limitation of this valuation

The limitations (compared to doing a proper formal valuation project for the brand owner) are: that they are based on public data only; that there is no input from management (in order to maintain consistency); that complex multi-national brands (such as IBM or Shell) are better valued as a series of separate pieces rather than in one lump; that certain key brands are not listed; and that only a limited amount of time can be spent on any one brand. The main limitation is that they tell you how much the brand is worth but not what is driving brand value nor what would increase brand value going forwards.

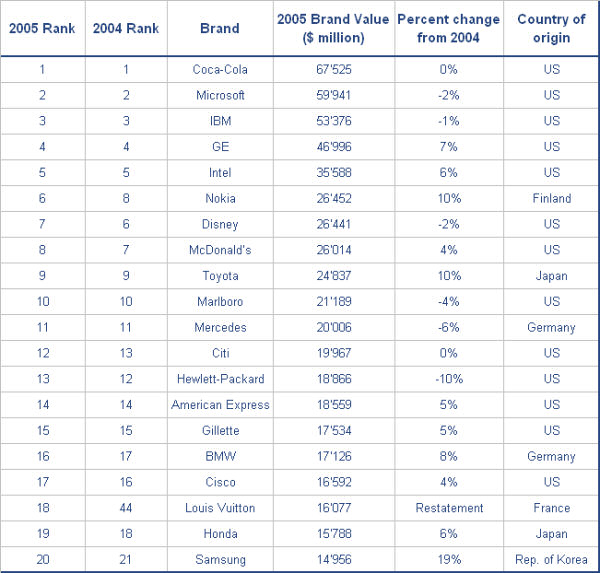

Top 20

The Winners

- eBay +21%

- HSBC +20%

- Samsung +19%

- Apple +16%

- UBS +16%

The Losers

- Sony -16%

- Morgan Stanley -15%

- Volkswagen -12%

- Levi’s -11%

- Hewlett-Packard -10%

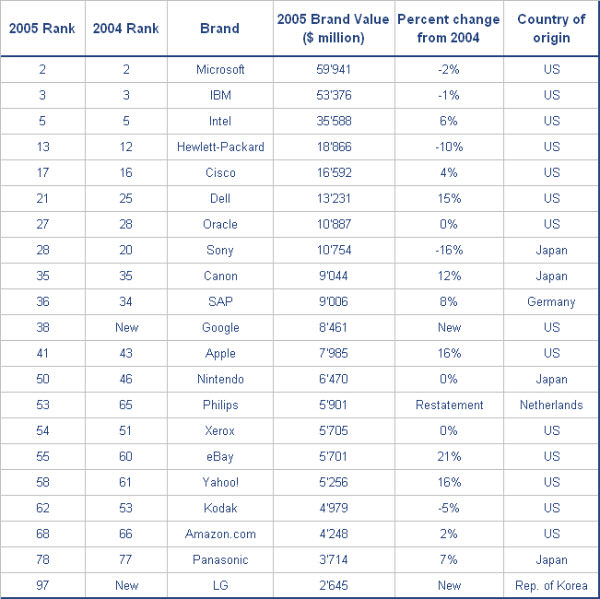

High-tech companies

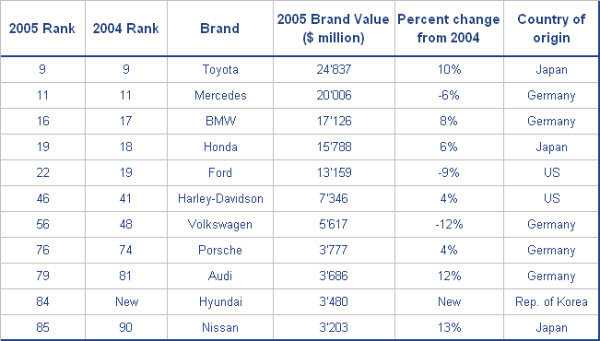

Car producer companies